Accrue Cost Accounting: Accrual Vs Cash Foundation Methods

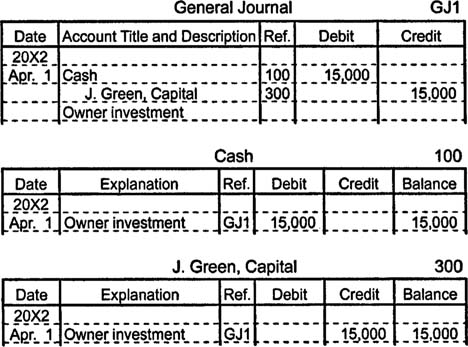

Search skilled steering right here, maybe from CPAs versed in worldwide nuances, to harmonize practices. With historic knowledge reflecting financial actuality, you forecast extra reliably, adjusting for seasonal fluctuations or economic shifts. Banks favor accrual as a result of it shows what you owe and what’s coming in, not just the money you’ve proper now. For instance, should you tutor somebody and ship them a bill midway via the month, you count that money right away.

How Is Accrued Price Recorded On Financial Statements?

This method ensures that a company’s financial place displays the true financial worth of the products or services offered, regardless of when the fee is actually received. The recognition of accrued revenue at period end follows the matching principle, the place revenues are acknowledged when earned, not necessarily when cash is acquired. Effective communication and adherence to deadlines are essential for managing accrued bills. Accruals guarantee expenses are acknowledged within the interval they were incurred, not simply when paid, which is key for accurate financial reporting. This requires clear communication between various departments, such as finance, operations, and human resources.

They present a more accurate picture of profitability, obligations, and financial well being. Comparable to accounts payable, accrued bills are future obligations for money funds to soon be fulfilled; hence, both are categorized as liabilities. Right Here, bills, when incurred, are not paid, and the company makes money funds in future.

Understanding Accounting Ideas And Standards

Accrued bills, as we’ve mentioned, are for bills incurred however not but billed. You may know the expense exists (like those accruing salaries), however you may not have the exact final quantity till the top of the period. BDC.ca also factors out that accrued expenses are sometimes short-term liabilities, anticipated to be paid throughout the next 12 months. Each accrued expenses and accounts payable are crucial components of an entire and correct steadiness sheet, reflecting all your small business’s current liabilities.

Without accruals, firms would solely present earnings and bills related to cash flows or money coming out and in of their bank accounts. The identical could occur with bills not being allotted to the correct period they were incurred. Accrued expenses are acknowledged before you obtain an bill, often before the amount owed is finalized. Accounts payable, however, are recorded when you obtain an invoice for goods or services already received. Guarantee your team knows the distinction between accrued expenses, accounts payable, and pay as you go expenses. Clear inner insurance policies and common coaching sessions can prevent confusion and ensure everyone seems to be on the identical web page.

Outstanding bills are bills for which the fee has been delayed, usually after receiving an bill. In distinction, accrued expenses have been incurred but have not been billed or invoiced. Like any accounting methodology, using accrued expenses has its benefits and disadvantages. Because you document them before paying, the deduction would possibly fall into a unique tax period than the precise money outflow. This timing distinction could be helpful or not, relying in your specific tax situation. It’s always finest to seek the guidance of with a tax skilled to strategize effectively.

- This distinction is necessary for correct financial reporting and managing your money flow.

- In fact, all public firms use accrual accounting since they need to comply with GAAP, which doesn’t enable the money foundation.

- The identical might happen with bills not being allocated to the right period they were incurred.

Real-world Instance: Accrued Taxes

While both symbolize cash your small business owes, the key difference lies in timing and documentation. Accrued expenses are recorded earlier than you obtain an bill, often before the precise quantity is even identified. Accounts payable, then again, are recorded after you obtain an bill for items or companies already delivered.

This requires diligent monitoring and a clear understanding of accounting durations to make sure correct monetary reporting. This adherence to requirements builds belief with investors, lenders, and other stakeholders. Sometimes, you create them firstly of the brand new accounting interval, right after closing the books for the earlier period.

The entry reverses firstly of the next reporting period, assuming the company follows by way of with the cost on time. Despite the reality that the cash outflow has not occurred, the expense is recorded within the reporting period incurred. On the present liabilities section of the stability sheet, a line merchandise that regularly appears is “Accrued Expenses,” also called accrued liabilities. As An Alternative of relying on monthly statements to inform your curiosity accruals, think about establishing a recurring journal entry using your credit score account terms.

![]()

Accrual accounting is like preserving rating of your money in a way that exhibits what’s really occurring in your corporation, even if the money hasn’t proven up yet. To make certain you’re not adding extra tasks to your to-do listing like having to inspect it and manually post, you wish to invest in a social media administration software. You discover one you like, and their pricing web page mentions you can save some huge cash by being billed yearly.

Paying off short-term debt is important as a result of it can help you keep away from excessive interest rates and late fees. Quick forward to the top of the month (let’s say it’s February), and you proceed to haven’t heard from the owner https://www.simple-accounting.org/ about payment. She won’t pick up the cellphone or reply her email, and her answering machine says she’s in Cuba.